Our Expert Team

Advanced AI trading insights and educational content for professionals Experienced professionals with decades of trading experience

Michael Hartnett

Michael Hartnett is the chief investment strategist at Bank of America. He is known for his profound market insights and accurate predictions and is called “the most accurate analyst on Wall Street.” He has accurately predicted several market fluctuations, including the global economic recession in 2019, the sharp drop in U.S. stocks in the first half of 2022, and the strong rebound of U.S. stocks in the second half of 2022.

Dora Kozak

Dora Kozak is your first contact in the group. She sends daily private messages with updates from Michael Hartnett, including educational insights on strategies and stock analysis. As the group’s support assistant, she helps all members get started and stay up-to-date.

Swan Liu – Chief Trading Strategist

With over 15 years of institutional trading experience, Swan specializes in identifying repeatable market structures.

He integrates these insights into our AI-assisted scanner logic.

Henry Brown-RiskAware Education Specialist

More than 7 years of experience in risk control and safety education, helping students improve their risk control and safety awareness

In-depth insights from professional stock analysts

Core Module

Market Basics

Stock Pricing Logic and Macroeconomic Correlation

Industry Cycle Characteristics and Policy Risk Identification

Any analysis model has time lag and probability attributes. All historical laws may be broken by policy changes or technological revolutions. It is not recommended to allocate more than 25% of the total position in a single industry.

Technical Analysis Practice

nterpretation of volume-price relationship and trend verification method

Mathematical modeling and execution discipline of stop-loss strategy

FAQ

Can completing the course increase investment returns?

Important statement: This course does not promise any investment returns. The teaching content focuses on: the knowledge system construction of stock analysis methodology, the application principles of risk management tools, and the behavioral training of trading discipline. Systematic learning can reduce the error rate of irrational decision-making (, but there are inherent risks in the market, and investors may face principal losses.

Does the course recommend specific stocks?

The course does not involve any stock recommendations, buy and sell point tips or code analysis, which is the compliance red line of financial education courses. You will learn: the general analysis framework of the relationship between volume and price, objective indicators for industry cycle positioning, mathematical modeling logic of stop-loss strategies, and all cases only use terminated historical data (such as crude oil futures fluctuations in 2008).

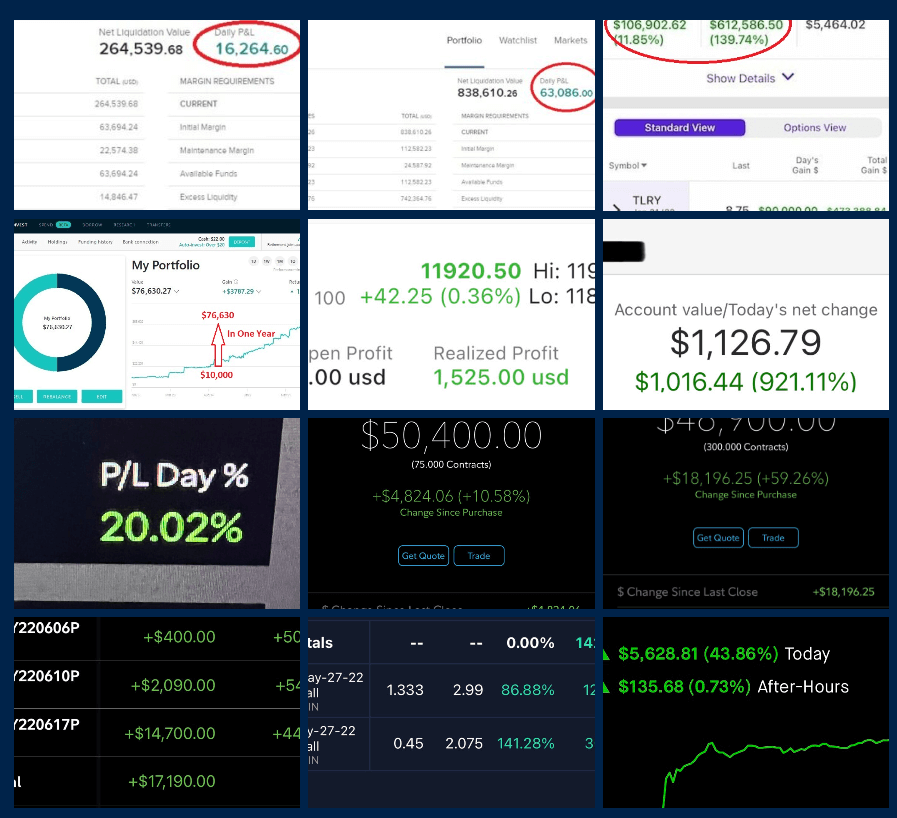

Can teachers’ actual performance be used as a reference?

According to global financial regulatory guidelines: past performance shown by teachers does not indicate future results, personal account returns are not replicable, and the core value of the course lies in delivering verifiable methodology. We provide: • Strategy historical backtest data (S&P 500 Index from 2010 to 2023) • Third-party academic papers verifying the conclusions of the analysis model. All materials state that “backtest results do not represent actual returns”

Is the course effective for students with no basic knowledge?

Regulatory compliance: The operation of this platform complies with the provisions of the U.S. Securities and Exchange Commission (SEC) educational guidance, the guidelines of the U.S. Financial Industry Regulatory Authority (FINRA) and the EU MiFID II knowledge product specifications, and the China Securities Regulatory Commission’s “Securities and Futures Investor Suitability Management Measures” stock investment may result in principal loss, and the course content is not used as an investment basis. Disclaimer: By joining, you agree to receive only educational content. Stock investment in this content may result in the total loss of principal, and the course does not constitute any form of investment advice. Historical case data source: CRSP/Wind (1990-2025), backtest results do not predict future performance.

© 2024 All rights reserved